The Hype Cycle of Green Finance

After years of growing demand for green finance and the accompanying explosion of green financial products, the industry is facing credibility issues [i]. There has been no shortage of pledges and commitments from financial institutions to tackle climate change, but greenhouse gas emissions continue to rise [ii] and climate-related economic losses continue to increase [iii].

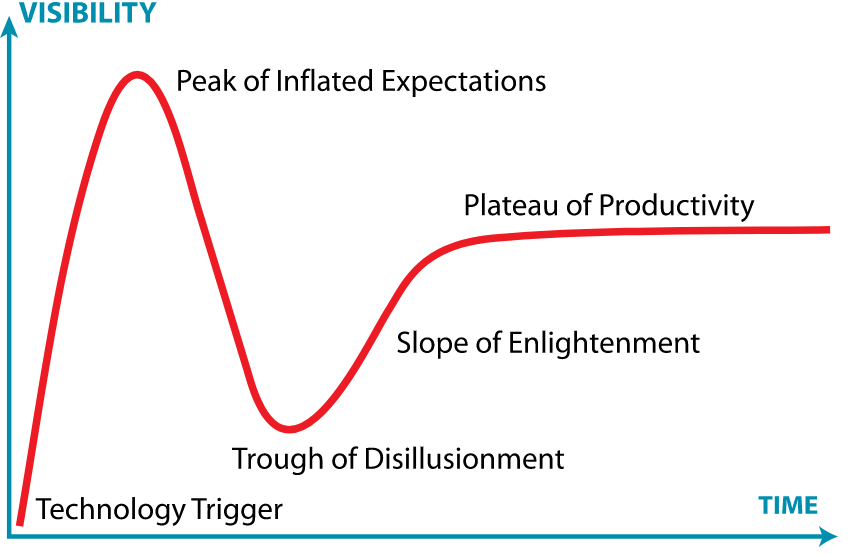

Regulators are starting to crack down on greenwashing and the discrepancy between institutions’ messaging and their actions [iv],[v],[vi]. Financial institutions themselves are starting to back-track on their own commitments at the point they need to become tangible [vii]. To summarise in Gartner’s famous hype cycle terms: it looks like green finance has entered the ‘Trough of Disillusionment’ after years of inflated expectations.

Despite this rather disappointing backdrop, demand for sustainable funds continues to grow [viii] and the need to allocate capital to genuinely green, sustainable, or resilient activities is as great as ever. Delivering on the Paris Agreement to keep global warming well below 2°C, investing in climate resilient infrastructure around the world and reversing biodiversity loss will require trillions of dollars of investments [ix],[x],[xi]. This will mean integrating sustainability considerations into every investment or financing decision we make for decades to come.

As such, we cannot afford to get green finance wrong. We need to move away from labelling financial products or strategies as green, climate, or sustainable because some light touch “ESG integration” that is in operation. Instead, we must focus on credible and effective strategies and products that provide meaningful support to the real economy as firms transition to a low-carbon, climate resilient, and nature positive economy. But how do we move from ‘disillusionment’ to ‘enlightenment’?

Let’s take a step back and look at how green finance, in theory, can contribute to these objectives.

Turning Green Finance Theory…

Most definitions of ‘green finance’ imply the use of a financial instrument or activity to ultimately deliver an environmental or sustainable benefit. While financial instruments are labelled as ‘green’, holding a green investment does not necessarily mean any positive change in the real economy has been achieved with regard to reducing greenhouse gas emissions, ensuring there is financial resilience in the face of climate change, or preventing environmental degradation [xii].

Overall, there are three levers for financial institutions to have a meaningful positive impact in the real economy [xiii]:

- Cost of capital: Reduce the cost of capital for sustainable activities and/or increase the cost of capital for unsustainable activities;

- Liquidity: Make more capital available for sustainable activities and less capital available to unsustainable activities;

- Changing corporate practices: Engage with issuers, such as companies, sovereigns, or individuals, to accelerate the use of sustainable practices.

Institutional investors such as pension funds, insurers, asset managers and banks (rather than retail investors) have the means to use these levers to drive change in the real economy. Not only do they manage trillions of dollars of capital, but they also have the long-term investment horizons needed to address long-term issues, and many have made strong net zero or other sustainability commitments [xiv].

Additionally, they invest across all asset classes. Primary markets or direct financing decisions, such as loans, directly impact both the cost of capital and access to liquidity. So, what these institutions finance matters. Whether that is private equity investors that can directly influence corporate behaviour [xv] or banks who can choose not to lend into areas where we know that there will be significant environmental harm, such as new coal fields.

While this is the theory, there is a way to go still to turn it into practice.

...Into Green Finance Practice

Data and information are the lifeblood of financial markets. By its very nature, green finance requires that new pools of non-financial data and information be integrated into financial decision-making. Challenges around current ESG, sustainability, or climate-related data availability and suitability have been widely discussed [xvi]. Proposed industry solutions focus on disclosures and standardisation thereof by corporates and financial institutions [xvii].

Achieving comprehensive and credible sustainability disclosures across all sectors of the economy will take time, a lot of time. However, proactive financial institutions could tap into the wealth of climate related information that is already available within academia and public and non-profits on numerous financially-material sustainability issues, such as greenhouse gas emissions, physical climate hazards, and nature loss. What is missing is the translation of these scientific insights into formats, metrics, measures, and tools that are relevant and practical for financial institutions, but which retain the nuance and granularity needed to be actionable and effective.

More and better data in and of itself is not sufficient to drive the real economy changes we need to see, particularly if they remain isolated in reporting and disclosure functions. Financial institutions themselves acknowledge that sustainability insights need to be embedded across an institution’s financial decision-making, client engagement, and operational processes to drive real economy impacts [xviii].

We therefore need better analytics and solutions tailored to support decision-making in financial institutions, including:

- Risk management and pricing;

- Sustainability target setting, transition planning and progress monitoring;

- Transition finance product development;

- Client due diligence and screening;

- Stewardship and engagement.

These business applications are not areas in which scientists, public institutions, or civil society organisations, who create a lot of scientific sustainability data, have the skillset to translate this data into information the financial sector can consume.

While financial institutions are starting to upskill and build teams to deal with sustainability issues and datasets [xix], much of the scope for improvement and innovation remains in providing datasets in useful formats, for the right application at the right time. Success stories from FinTech, InsurTech, RegTech or WealthTech, show that it is possible to build scalable business models around improving financial decision-making and operational processes.

Green Fintech for Green Finance

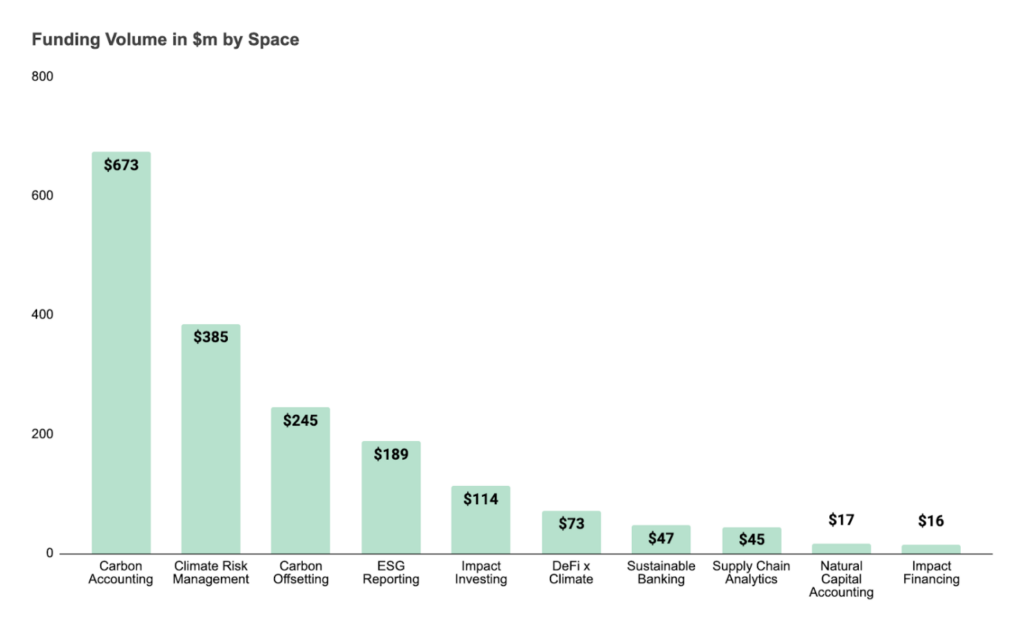

‘Green FinTech’ or ‘Climate FinTech’ is rapidly becoming a high growth area in its own right within the wider FinTech ecosystem, as more and more venture capital flows in [xx], and green fintech taxonomies are being created [xxi].

However, the bulk of investment to date is flowing into accounting and reporting solutions, and it is not always clear how these will support a rapid transition to a net zero, climate resilient or nature positive economy. Linking carbon footprints to payment transactions or aggregated sustainability ratings based on “blackbox” methodologies is not robust enough to realign capital allocation. Proactive financial institutions could tap into the wealth of climate related information that is already available within academia and public and non-profits.

At the UK Centre for Greening Finance and Investment (CGFI) we aim to accelerate the adoption and use of scientifically robust climate and environmental data and analytics by financial institutions globally. This includes supporting analytics providers to develop robust and credible solutions that will deliver on the promise of green finance. There are many ways to go about developing more robust solutions, but we do believe it should build on the following principles:

- Bottom-up analysis based on asset-level data;

- Transparency of methodologies, datasets and assumptions;

- Communicating uncertainties in models and datasets used.

At our London and Leeds CGFI Innovation Hubs we particularly want to support new ideas and solutions that:

- Support financial institutions to drive real economy impacts across all asset classes;

- Target institutional investors to (re)allocate capital with long-term investment horizons;

- Focus on financial institution’s operational processes beyond reporting and accounting.

In short, the financial industry needs robust and reliable climate and environmental analytics that make the ‘green’ in green finance credible and verifiable as an effective tool to tackle the climate crisis. There is actual demand from leading financial institutions asking for transition-relevant data and metrics [xxii]. And we have the necessary skills within the UK, across the climate and environmental science, fintech, and financial services, to make it happen.

Find out more about the UK Centre for Greening Finance and Investment

Authors

Christophe Christiaen

Data, Innovation and Impact Lead

Iain Clacher

Co-Lead, Commercialisation and Supporting the Ecosystem

Yllka Hysaj

Research Associate

Michael Wilkins

Co-Lead, Commercialisation and Supporting the Ecosystem

Sources

[i] https://www.economist.com/leaders/2022/09/29/the-fundamental-contradiction-of-esg-is-being-laid-bare

[ii] https://www.ipcc.ch/report/sixth-assessment-report-working-group-i/

[iii] https://www.eea.europa.eu/ims/economic-losses-from-climate-related

[iv] https://www.ftadviser.com/investments/2022/10/19/hsbc-adverts-banned-after-greenwashing-complaints/

[v] https://www.reuters.com/business/german-police-raid-deutsche-banks-dws-unit-2022-05-31/

[vi] https://www.fca.org.uk/news/press-releases/fca-proposes-new-rules-tackle-greenwashing

[vii] https://www.bloomberg.com/news/articles/2022-10-17/bankers-told-they-can-ignore-binding-fossil-finance-restrictions

[viii] https://thegiin.org/research/publication/impact-investing-market-size-2022/

[ix] https://unfccc.int/news/private-investments-are-crucial-to-achieve-paris-goals

[x] https://www.unep.org/resources/adaptation-gap-report-2021

[xi] https://www.unep.org/resources/state-finance-nature

[xii] https://www.ipe.com/viewpoint-investing-in-green-doesnt-equal-greening-the-world/10043518.article

[xiii] https://www.smithschool.ox.ac.uk/sites/default/files/2022-04/Sustainable-Finance-and-Transmission-Mechanisms-to-the-Real-Economy.pdf

[xiv] https://www.iigcc.org/

[xv] https://www.smithschool.ox.ac.uk/sites/default/files/2022-04/Sustainable-Finance-and-Transmission-Mechanisms-to-the-Real-Economy.pdf

[xvi] https://www.economist.com/special-report/2022/07/21/the-signal-and-the-noise

[xvii] https://www.ifrs.org/news-and-events/news/2021/11/ifrs-foundation-announces-issb-consolidation-with-cdsb-vrf-publication-of-prototypes/

[xviii] https://climatealignment.org/wp-content/uploads/dlm_uploads/2022/09/finance_transition_data_insight_brief.pdf

[xix] https://www.ft.com/content/6c59ed7a-170b-4898-81a2-7420f0c28888

[xx] https://commerzventures.com/climatefintech

[xxi] https://greendigitalfinancealliance.org/green-fintech-classification/

[xxii] https://climatealignment.org/wp-content/uploads/dlm_uploads/2022/09/finance_transition_data_insight_brief.pdf