Climate stress testing through the GRII people, planet and prosperity lens

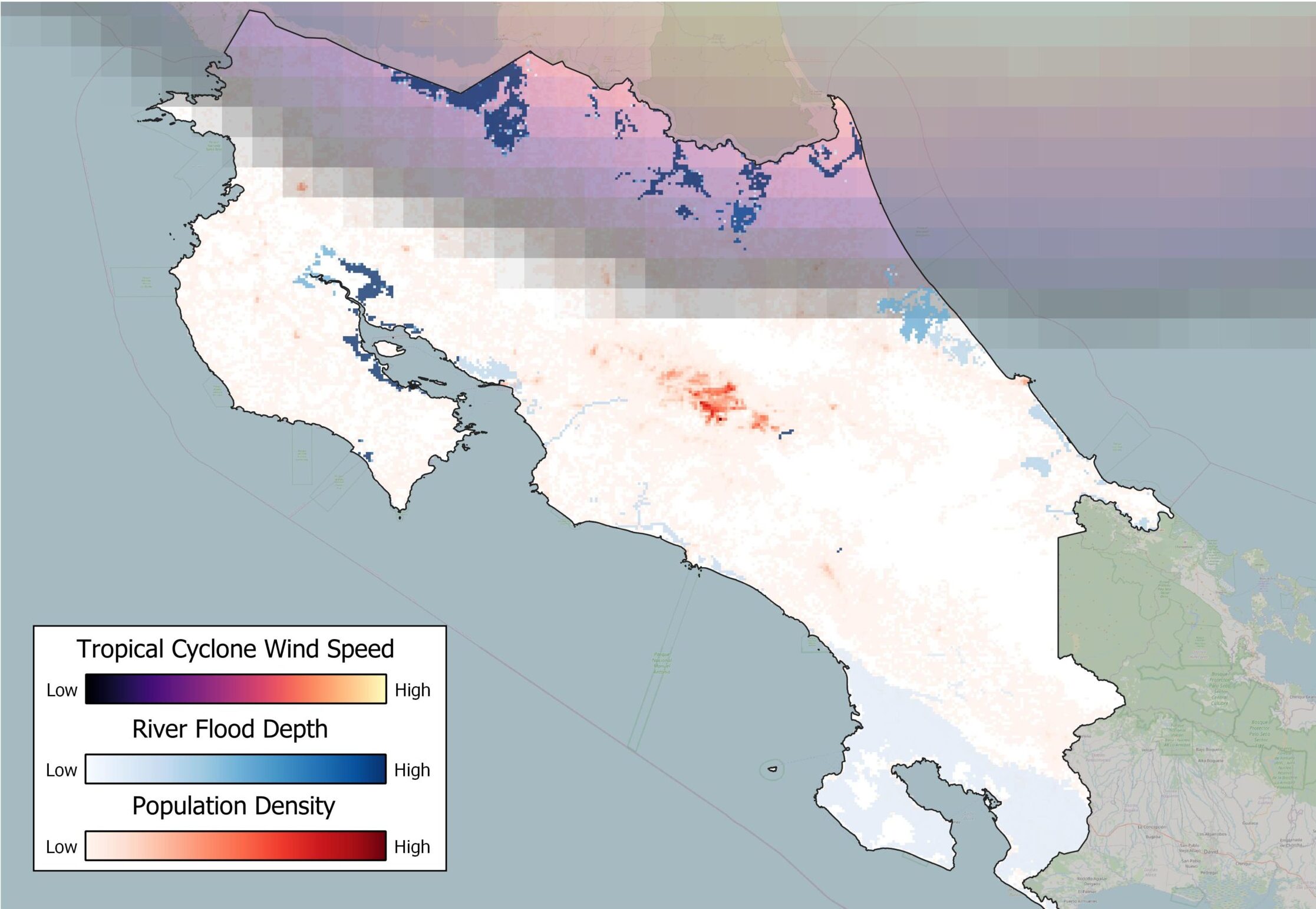

The Global Resilience Index Initiative (GRII, now the Resilient Planet Data Hub) provides data to feed into micro and macro-level analyses of both physical climate financial risks and nature-related financial risks. In this case study, we demonstrate this for Costa Rica. Costa Rica is highly vulnerable to hydrometeorological extreme events with over 1.3 million people being affected over 1980-20171 and over two thirds of GDP and population exposed to several risks.2

The Government projects the impacts of extreme events on infrastructure will reach 0.7-2.5% GDP in 2025.3 The country has strong adaptation plans, which respond to flood, drought and tropical cyclone risks. GRII provides data on these key hazards, as well as population, economic and critical asset exposures.

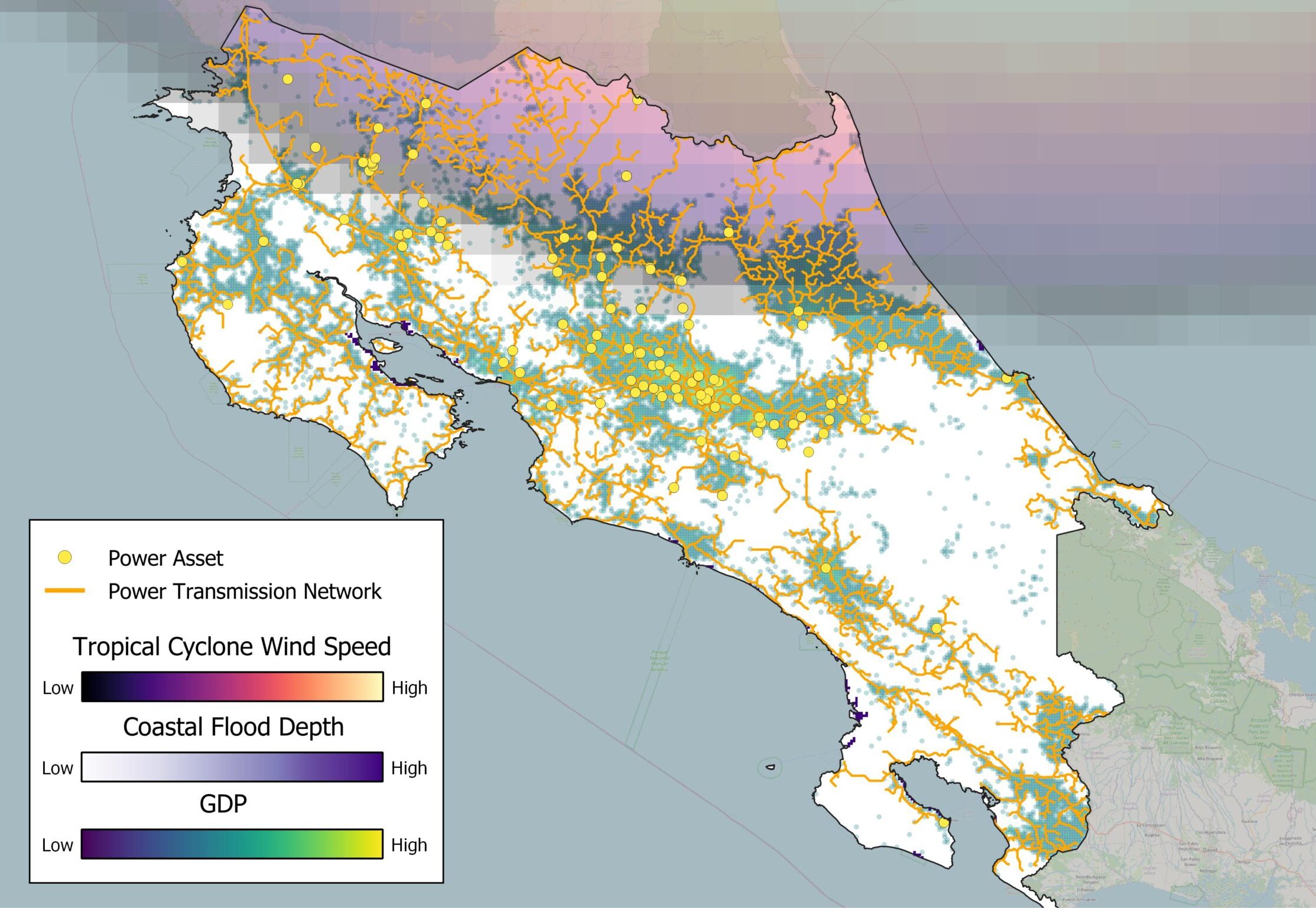

Hazards like flooding and tropical cyclones result in both direct damages to infrastructure and building and indirect losses to the economy. Asset-specific and hazard-specific damage functions from GRII can estimate the level to which an asset might be impaired leading both to production loss (e.g. reduced electricity production) as well as reconstruction costs.

(a) Mapping population exposure to flooding and tropical cyclones

(b) Mapping economic assets exposure to flooding and tropical cyclones

Production loss will impact firms directly, likely reducing cash flows, and potentially impacting the equity valuation and probabilities of default. Local banks lending to these firms therefore might see an increase in unexpected losses, which in turn dampens the ability of these local banks to provide financing to rebuild damaged assets. Indirect economic impacts might impair transportation routes and transmission lines for electricity (due to high wind speeds or flooding), which disrupts services in other parts of the economy and could impact on wider macroeconomic variabilities, including employment, interest rates and GDP

The data provided by GRII to identify the key risk transmission channels can be used by financial sector institutions to develop scenarios and then assess the financial risk implications both at a micro-level and to the overall resilience of the national financial system. The need for these type of assessments has been highlighted by the Climate Working Group of Costa Rica’s Financial Supervisory Council (CONASSIF) and its four superintendencies across the financial system (SUGEF, SUGESE, SUGEVAL, SUPEN*), and by the Central Bank of Costa Rica.

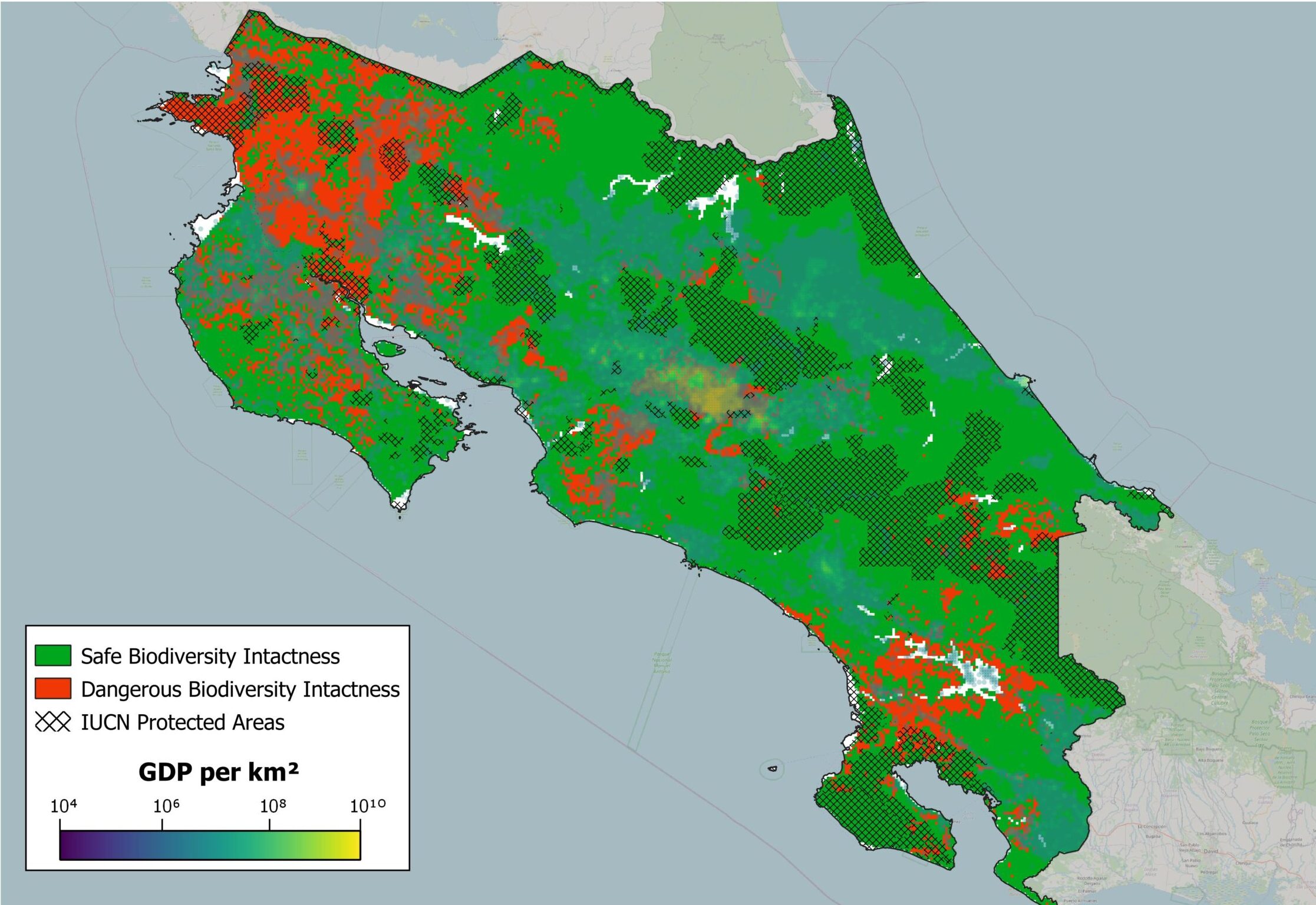

Nature-related risks are rising up the agenda of Central Banks and related supervisory entities across the financial system. In Costa Rica, the leadership of SUGESE (insurance regulator) has made breakthroughs on the need to apply insurance-based risk quantification across the economy.

Mapping areas with greater biodiversity loss using GRII can help identify regions that may be impacted by a decline in key ecosystem services. This could include impacts from a decrease in natural flooding defence or an increase in water stress (also relevant for cooling of power plants), which could also lead to GDP impacts at the national level, increasing pressure on inflation with macro-financial risks spreading.

References

Sources: Instituto Meteorológico Nacional. (2021). Análisis de la mortalidad por eventos meteorológicos extremos en Costa Rica. Período 1980-2017. IMN;

Deubelli, Teresa. (2019) “Hacia una infraestructura resiliente y sustentable: Un estudio de caso sobre la gobernanza de la resiliencia en la infraestructura crítica en Costa Rica.”;

Contraloría General de la Republica (2018) Presión sobre la Hacienda Pública en un contexto de variabilidad y cambio climático: desafíos para mejorar las condiciones presentes y reducir los impactos futuros https://cgrfiles.cgr.go.cr/publico/docs_cgr/2017/SIGYD_D_2017015617.pdf;

Gobierno de Costa Rica (2022). Reporte de avances en la implementación del PLAN NACIONAL DE DESCARBONIZACIÓN al 2021. https://dev.cambioclimatico.go.cr/wp-content/uploads/2022/02/Reporte-final-de-Descarbonizacion-Preview.pdf.

*CONASSIF: Consejo Nacional de Supervisión del Sistema Financiero

SUGEF: Superintendencia General de Entidades Financieras

SUGEVAL: Superintendencia General de Valores

SUGESE: Superintendencia General de Seguros

SUPEN: Superintendencia de Pensiones

Source: Oxford Sustainable Finance Group