What is Spatial Finance?

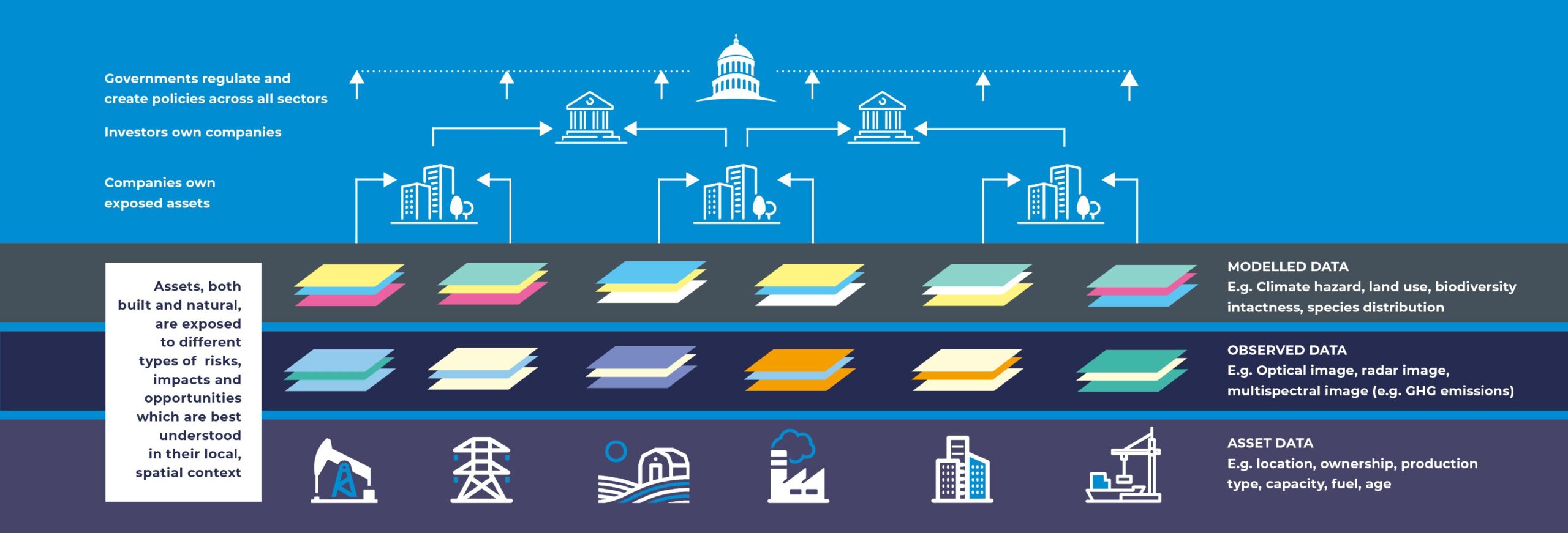

‘Spatial Finance’ is the integration of geospatial data and analysis into financial theory and practice. Existing geospatial datasets are being augmented and new ones made available as a result of rapid recent developments in earth observation and remote sensing. Advances in machine learning mean that these datasets can be processed in near-real time and at scale, making them relevant for many financial institution applications. The combination of these technologies has the potential to transform the availability of information in our financial system. This could have a transformative effect on how risks, opportunities and impacts are measured and managed by financial institutions.

Why is it relevant?

Spatial finance offers insights at the level of individual physical assets, linking financial instruments to activities in the real economy. These insights can then be aggregated at the company, portfolio or country level. This bottom-up approach is important to understand a wide range of sustainability and financial issues, in a more granular and actionable way than traditional top-down approaches allow. Analysis at the asset level can be significantly enriched by geospatial datasets, particularly for climate and environmental risk and impact applications. Geospatial datasets, including satellite remote sensing, offer a complementary source of information to corporate disclosures. An observed or modelled data source that can be more neutral, comparable or frequently available. Thus, improving transparency and reducing information asymmetries within our financial system.

Spatial Finance Initiative

The Spatial Finance Initiative, which is now part of the UK Centre for Greening Finance and Investment, was set up to mainstream geospatial capabilities into financial decision making globally and promote the development of new spatial finance applications. It was established by the Alan Turing Institute, Satellite Applications Catapult, and the Oxford Sustainable Finance Group to bring together research capabilities in space, data science and financial services and make them greater than the sum of their parts.

To achieve this mission we are pursuing three interrelated activities:

- Creating open asset-level datasets

- Upskilling and capacity building

- Promoting applied multidisciplinary collaborations and research

GeoAsset

The Spatial Finance Initiative’s GeoAsset project is a public goods endeavour that creates and disseminates global, open asset databases for high impact industries.

In a manner that is analogous to the Human Genome Project, GeoAsset aims to create a digital footprint of the global economy by collecting openly available information on physical assets (e.g. location, ownership, capacity) and aggregating these in standardised templates.