It is essential that we achieve net zero by 2050, but the impacts of climate change are already being felt. Much more is already ‘baked in’ for the coming decade and beyond.Investing in adaptation and nature-based solutions (NbS) is essential and urgent. Climate change will have major effects on lives, economies and finance globally, but particularly in more climate vulnerable countries. The UNEP Adaptation Gap report, released last month, revealed the $366 billion adaptation financing gap that needs to be closed every year, and much of this from the private sector.

In response, at COP28, financial institutions, governments and researchers joined together to issue a call to collaboration to set the enabling environment for finance to flow including clearer adaptation targets, investment plans and disclosure, as well as new partnerships and powering up blended finance facilities.

A common theme underpinning each of these needs is data. Data is an essential enabler of finance and plans, yet today there are huge asymmetries in the availability and accessibility of data across countries and between governments, civil society and the private sector. This creates a barrier and can lead to biased and maladaptive actions.

Enter the Resilient Planet Data Hub, launched today at COP28, and co-convened by the University of Oxford, the UN Office for Disaster Risk Reduction and the Insurance Development Forum under the High Level Climate Champions Race to Resilience. The Hub provides high quality, globally consistent, open climate and nature risk and resilience data, accessible to all. By making data open, it forms a common language of risk that will help not only increase the transparency and quality of information, but also level the playing field, unlocking action and finance.

Over the past six months, as part of the new Resilient Planet Finance Lab and with the support of Climate Arc, the UK Natural Environment Research Council (NERC) and UKPACT, we’ve brought together both public and private financial institutions, policymakers, regulators, and the private sector all over the world to test and demonstrate how we can use this data to help drive investments in adaptation and nature. All our findings are given on our new platform: resilient-planet-data.org. Here is a summary of what we found:

Jump to topic

Data-Driven Disclosures and Plans

Physical climate risk disclosure, through frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), are a critical step to understanding the risks posed to a company or asset by climate change, pricing this into decisions and building this into plans. But tools and approaches to do this lag behind transition risk.

We worked with Impax Asset Management to explore how open data can support them disclosing their physical climate risk. We’ve also supported the Transition Plan Taskforce in their work to integrate adaptation within corporate and financial sector transition plans through their dedicated working group.

Data-Driven Stress Testing and Scenario Analysis

Climate scenario analyses are being used increasingly by financial institutions to understand the risks of climate change and explore options to adapt to these risks. Rigorous climate scenario exercises can be data and model intensive, but are important for informing decisions made under uncertainty.

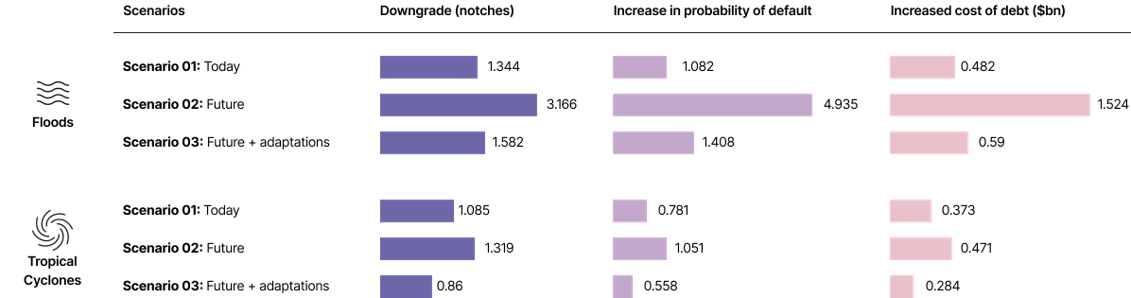

With UK PACT, the University of Oxford, the UK Centre for Greening Finance Investment, and the Resilient Planet Finance Lab are exploring how data from the Resilient Planet Data Hub GRI Risk Viewer can be used to develop scenarios to assess sovereign climate risk and the benefits of adaptation in Thailand. Extreme flood and typhoon scenarios (equivalent to a 1-in-500-year return period event) were constructed for today’s climate and for a future high emission (RCP 8.5) climate in 2050.

Data-Driven Adaptation Strategies

Once the risks have been understood, financial institutions need evidence to inform adaptation. This could include information on the benefits of adaptation as well as where, and how, to adapt. We’ve supported the work of the UNEP FI Principles of Responsible Banking to look at frameworks, metrics and targets for adaptation, including analysing how existing sustainability metrics can be applied to adaptation plans.

To show how data can be used to analyse adaptation options, as part of the UKPACT project, a set of adaptation scenarios were constructed to explore how different adaptation measures can reduce losses, including improved building codes, increased infrastructure resilience, and greater insurance penetration.

By running these six scenarios (three for flood and three for cyclone) through a sovereign credit risk model, we were able to calculate the impact on Thailand’s sovereign credit rating as a result of extreme flood and typhoon events.

The results show clearly that investing in adaptation can significantly reduce Thailand’s sovereign credit risk in the future. For future flooding, our model shows that additional adaptation investments could prevent a downgrade of Thailand’s sovereign credit rating to sub-investment grade if a 500-year flood were to occur.

Such a downgrade may have had serious implications for Thailand’s economy: reducing investor confidence and foreign investment, increasing the borrowing costs for domestic banks and corporates, and negatively affecting economic growth. Results of adaptation scenario analyses such as this can serve as the evidence base to governments and corporates about the macro-economic benefits of investing in adaptation.

Data-Driven Deals

In 2020, $9.1 billion USD was invested in transport infrastructure in East Africa. Ensuring these investments take physical climate risks into account is critical, given that climate risks will materialize over the lifetime (50-70 years) of infrastructure assets.

Using climate risk data from the Resilient Planet Data Hub, the East Africa Infrastructure Resilience Tool calculates the risk of flooding to transport infrastructure both today and in the future for four east African countries.

In addition to quantifying the risk, the tool also calculates the risk reduction benefits of different adaptation options. By comparing the costs of adaptation with its benefits (in terms of avoided risk), the tool calculates benefit-cost ratios for different adaptation options for each exposed infrastructure asset. Using this information, an investor can then prioritize where and how to invest in adaptation.

Data-Driven Investment

Nature faces a global decline at an unprecedented rate in human history. Yet, investing in nature-based solutions can bring major benefits for livelihoods, adaptation, carbon and biodiversity. Investors are increasingly investing their capital in ventures that resonate with their environmental and social values.

One emerging trend is funding green infrastructure and nature-based solutions (NbS), such as mangroves. The Resilient Planet Data Hub provides data that can help both public and private financial institutions make informed investment choices. This includes assessing the effectiveness of restoration and protection projects, understanding the drivers of environmental degradation, estimating costs, and assessing potential financial returns and risk mitigation.

The platform brings together datasets that help financial institutions uncover new opportunities. It helps identify viable projects and structures financial models for ecological restoration, facilitating collaboration between local communities, governments, and investors. In collaboration with the Global Centre on Adaptation and teams in the Environmental Change Institute we are developing geospatial tools to aid in the identification and prioritization of NbS in Bangladesh.

Working in Partnership

In the coming year, through the Resilient Planet Finance Lab, we will continue to work closely with FIs, governments and civil society to develop new metrics, tools, evidence, taxonomies and frameworks to support the integration of adaptation into financial decisions.

We look forward to new partnerships kicking-off and to building new collaborations. Our approach is to work collaboratively to develop and test tools, and then take these to scale and make data available via the Resilient Planet Data Hub platform.

The data, tools and methodologies we co-develop with partners around the world not only help in assessing physical climate risks but also in demonstrating the cost-effectiveness of various adaptation strategies. This is crucial for integrating climate resilience into long-term investment planning, ultimately contributing to a more sustainable and resilient future.

Dr Nicola Ranger, Director, Resilient Planet Finance Lab with one of our two founding partners, Ekhosuehi Iyahen, Secretary General of the Insurance Development Forum (IDF), at COP28.

Partner consultation roundtable at COP28.

About

The Resilient Planet Data Hub is as an open resource for understanding and addressing climate and environmental risks. It offers essential data for financial institutions and investors for risk disclosures and the data and tools to guide adaptation and resilience decisions. The Resilient Planet Finance Lab brings together public and private institutions to share knowledge and co-develop solutions to mobilize finance for resilience.

Both are proudly supported by the Environmental Change Institute at the University of Oxford and benefit from inputs experts across the university, including the Oxford Programme for Sustainable Infrastructure Systems, the ECI Resilience and Development Group and the UK Centre for Greening Finance and Investment, and our partners across many institutions globally.

We wish to sincerely thank our funders without whom this would not be possible: the UK Natural Environment Research Council, Climate Arc, the FCDO (UKPACT and Climate Compatible Growth programmes), the Global Centre on Adaptation, the Oxford Martin School, the World Bank and the Insurance Development Forum.